Student loan management can be a daunting task, especially when it comes to Income-Driven Repayment (IDR) recertification. Many borrowers find themselves confused about the process and what steps to take when applications are temporarily closed. If you're one of the millions of borrowers navigating this situation, understanding your options is crucial to maintaining financial stability and ensuring compliance with repayment plans.

Managing student loans effectively is not just about making monthly payments; it's about understanding the various repayment plans available and how they impact your financial future. IDR plans are designed to make repayment more manageable by aligning monthly payments with your income and family size. However, the recertification process is essential to ensure that your payments remain accurate and affordable.

While IDR applications may be closed temporarily, borrowers still have several options to manage their loans and avoid falling behind. This guide will walk you through the process, provide valuable insights, and offer actionable advice to help you navigate this challenging situation. Let’s dive in!

Read also:Tampa Fire A Comprehensive Guide To Understanding The Phenomenon

Table of Contents

What is Income-Driven Repayment (IDR)?

Understanding the IDR Recertification Process

Options When Applications Are Closed

Short-Term Solutions for Borrowers

Long-Term Planning and Strategies

Read also:Buscar Kid And His Mom Video The Full Story Behind The Viral Sensation

Common Questions About IDR Recertification

The Financial Impact of Delays in Recertification

Tips for Successful IDR Recertification

Resources for Further Assistance

What is Income-Driven Repayment (IDR)?

Income-Driven Repayment (IDR) is a federal student loan repayment plan designed to make monthly payments more manageable for borrowers based on their income and family size. Unlike standard repayment plans, which require fixed payments over a set period, IDR plans adjust payments annually to reflect changes in a borrower's financial situation.

There are several types of IDR plans, including:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Each plan has its own eligibility criteria and benefits, but all aim to reduce the financial burden on borrowers by capping monthly payments at a percentage of their discretionary income.

Eligibility for IDR Plans

To qualify for an IDR plan, borrowers must meet specific criteria, such as having eligible federal student loans and demonstrating a partial financial hardship. Eligible loans include Direct Loans, Federal Family Education Loans (FFEL), and certain consolidation loans.

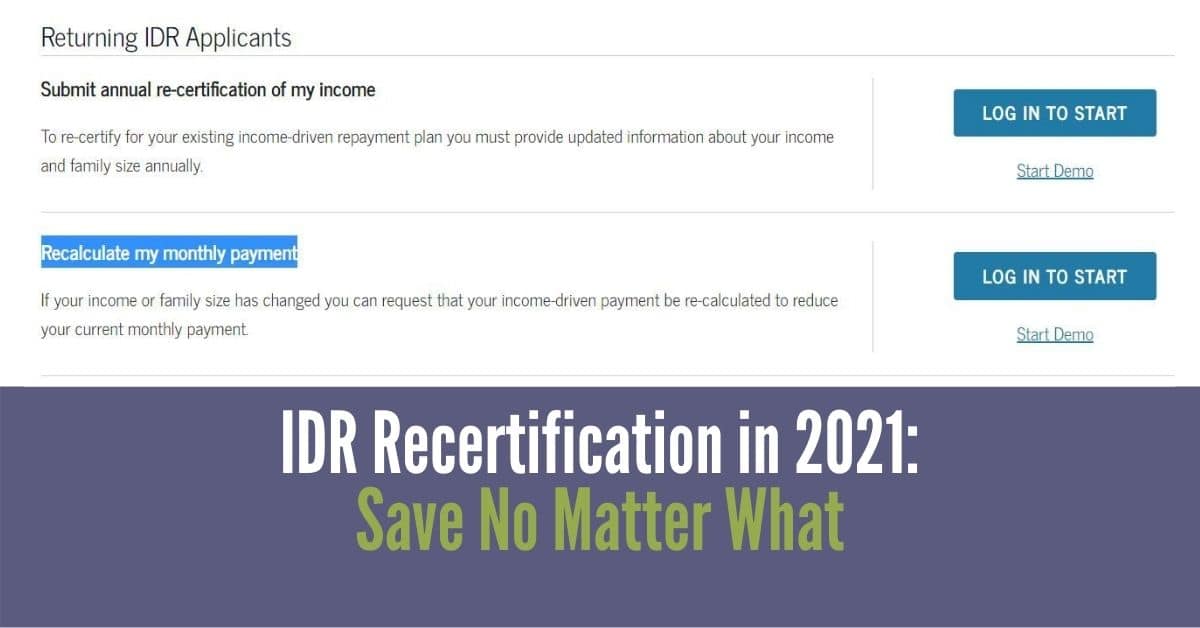

Understanding the IDR Recertification Process

The IDR recertification process is an annual requirement for borrowers enrolled in these plans. During recertification, borrowers must update their income and family size information to ensure that their monthly payments remain accurate and affordable. This process typically involves submitting updated tax returns or income documentation to their loan servicer.

Steps for Recertification

Here’s a step-by-step guide to successfully completing the IDR recertification process:

- Gather necessary documents, such as tax returns, W-2 forms, or pay stubs.

- Complete the recertification form provided by your loan servicer.

- Submit the completed form and supporting documents by the deadline.

- Monitor your account for updates and confirm that your recertification has been processed.

Options When Applications Are Closed

If IDR applications are temporarily closed, borrowers may feel unsure about how to proceed with their recertification. However, there are several options available to help manage your loans during this period:

- Forbearance: Request a temporary suspension of payments through forbearance, which can provide short-term relief.

- Deferment: If eligible, apply for deferment to pause payments without accruing interest.

- Alternative Repayment Plans: Consider switching to a different repayment plan, such as the Extended Repayment Plan, until IDR applications reopen.

Impact of Forbearance and Deferment

While forbearance and deferment can provide temporary relief, it’s important to understand the potential long-term impact on your loan balance. Interest may continue to accrue during these periods, increasing the total amount owed over time.

Short-Term Solutions for Borrowers

For borrowers facing immediate financial challenges, there are several short-term solutions to consider:

- Communicate with Your Loan Servicer: Reach out to your loan servicer to discuss available options and request assistance.

- Temporary Payment Adjustments: Some servicers may offer temporary payment reductions or adjustments to help borrowers stay current.

- Explore Loan Consolidation: Consolidating your loans into a single Direct Consolidation Loan may simplify repayment and provide access to additional repayment plans.

Long-Term Planning and Strategies

While short-term solutions can provide relief, it’s essential to develop a long-term plan for managing your student loans. Consider the following strategies:

- Track Your Progress: Regularly monitor your loan balance, interest rates, and repayment progress to ensure you’re on track for loan forgiveness or payoff.

- Explore Refinancing Options: If eligible, refinancing your loans through a private lender may offer lower interest rates and reduced monthly payments.

- Plan for Future Recertifications: Stay organized and prepare for future recertifications by keeping accurate records of your income and family size changes.

Maximizing Loan Forgiveness Opportunities

Borrowers enrolled in IDR plans may qualify for loan forgiveness after making qualifying payments for 20-25 years, depending on the plan. Understanding the requirements for forgiveness and maintaining accurate records of your payments can help ensure you meet the criteria.

Common Questions About IDR Recertification

Here are some frequently asked questions about the IDR recertification process:

- What happens if I miss the recertification deadline? Missing the deadline may result in higher payments or a loss of eligibility for the IDR plan. Contact your loan servicer immediately to discuss options.

- Can I change my IDR plan? Yes, borrowers can switch between IDR plans at any time by contacting their loan servicer.

- Will my payments increase if my income goes up? Yes, IDR payments are based on income, so an increase in income may result in higher monthly payments.

The Financial Impact of Delays in Recertification

Delays in IDR recertification can have significant financial consequences for borrowers. Failure to recertify on time may lead to increased monthly payments, penalties, or even default if payments are missed. It’s crucial to prioritize recertification and seek assistance if needed.

Minimizing Financial Risks

To minimize financial risks, borrowers should:

- Set reminders for recertification deadlines.

- Stay informed about updates or changes to IDR policies.

- Build an emergency fund to cover unexpected financial challenges.

Tips for Successful IDR Recertification

Here are some tips to ensure a smooth and successful IDR recertification process:

- Submit all required documentation promptly and accurately.

- Verify that your loan servicer has received and processed your recertification.

- Stay proactive by addressing any issues or questions with your servicer as soon as possible.

Importance of Organization

Keeping detailed records of your income, family size, and communication with your loan servicer is essential for a successful recertification. Organize your documents in a secure location and update them regularly to avoid delays or errors.

Resources for Further Assistance

For additional support and guidance, consider the following resources:

- Federal Student Aid – A comprehensive resource for student loan information and assistance.

- Consumer Financial Protection Bureau – Offers guidance and resources for borrowers navigating student loan challenges.

- Student Loan Borrower Assistance – Provides free information and advice for student loan borrowers.

Conclusion

Navigating the IDR recertification process can be challenging, especially when applications are temporarily closed. However, by understanding your options, staying informed, and taking proactive steps, you can successfully manage your student loans and avoid financial pitfalls. Remember to prioritize communication with your loan servicer, maintain accurate records, and explore available resources for assistance.

We encourage you to share this article with fellow borrowers and leave a comment below if you have any questions or insights to add. For more information on student loan management, explore our other articles and resources. Together, we can work toward a financially secure future!